Enhanced Coverage

WHY ENHANCED PROTECTION?

The attorneys at SSM highly encourage our clients to have the BEST TITLE PROTECTION available. That is why SSM proudly offers the Eagle Policy as Agent for First American Title Insurance and the Enhanced Homeowner Policy through Stewart Title Guaranty.

6 KEY ADVANTAGES of ENHANCED POLICIES

- Survey coverage for encroachments

- Property appreciation coverage up to 150% in first 5 years

- Protection against violations of subdivision restrictions

- Zoning and building permit violations

- Post policy encroachments

- Post policy forgery

** deductibles apply **

WHO IS ELIGIBLE FOR ENHANCED COVERAGE

To a natural person or to a trustee of a living trust that has been established by a natural person for the estate planning purposes. The loan policy may be issued only where the borrower is a natural person or a trustee of such a living trust. The property to be insured must be improved, and must contain a 1-4 family residence, which may be a condominium. The property may not be under construction or about to be constructed. The Eagle policy is for completed residential structures only. The property must be improved. It cannot be vacant land.

WHO IS NOT ELIGIBLE FOR ENHANCED COVERAGE

- Cannot be commercial property that is vested in partnership, corporations, etc.

- Poor legal descriptions or large acreage

- Prior notice of illegal lots

- Prior notice of boundary disputes

- Mobile homes

- Vacant land

DEDUCTIBLES

- Prior notice of restriction and\or zoning violations. Violations of subdivision platting laws: 1% of policy amount or $2,500 (whichever is less)

- Failure to obtain building permits: 1% of policy amount or $5,000 (whichever is less)

- Violations of zoning laws and zoning restrictions: 1% of policy amount or $5,000 (whichever is less)

- Removal of fences or boundary walls that encroach on your neighbor’s property: 1% of policy amount or $2,500 (whichever is less)

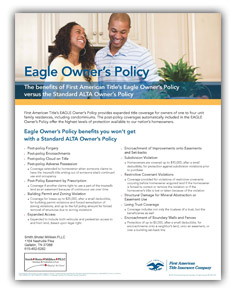

Here are two charts that compare the ALTA Standard Owners Policy coverage’s

with the additional protections afforded by our enhanced title policy choices

First American’s Eagle Policy

Stewart Title Guaranty Homeowner’s Policy

Here are examples of real life title claims illustrating how enhanced protection has paid off:

Example Claim One

John and Mary Homeowner own 9 acres of land in Rutherford County, Tennessee. As John and Mary aged, they found it cumbersome to maintain the entire tract of land so upon agreement with the adjoining neighbors, they sell to George and Susie Neighbor the four acres abutting their present home for $25,000.00. Because George and Susie Neighbor never intended to use the property for nay building expansion but rather as a buffer between the two properties, no one takes measures to go before the county planning and zoning commission to properly subdivide the property. A new deed is placed of record and the Neighbors obtain an ALTA policy for their new property. Six years later, George’s job transfers out of state and the Neighbor’s sell their home, including the four acres that they purchased from the Homeowner’s, to Property Virgins Rick and Rachel. As Rick and Rachel’s family grows, they wish to expand their current home onto the vacant 4 acres, however, they find they are unable to obtain a building permit because the additional land is considered an illegal subdivision for which no building permits may be issued. Rick and Rachel file a claim under their Eagle policy. Do they have coverage? YES, the Eagle policy provides coverage for violations of the Subdivision Map Act.

Example Claim Two

In 2005, John and Mary Homeowner travel to Gatlinburg, Tennessee in the Smokey Mountains and are so impressed with the peaceful forest, rushing creeks and wildlife that they decide to purchase a home in the area. Since their permanent residence is in California, they are only able to travel to Tennessee several times a year for holidays and vacations. In 2008, Freddie Fraud has figured out that he can assess tax information online from county register’s office and the trustee’s site. Freddie sees that the tax bills for the property are being sent out of state rather than to the property address. He watches the property for some time and determines it to be uninhabited. Thereafter, he prepares and records a fraudulent deed transferring the property from John and Mary Homeowner to himself. He subsequently offers the property, including all furnishings, for a bargain price and almost immediately has a contract and closes within 30 days with all proceeds being wired to his offshore account. John and Mary Homeowner travel to Tennessee for Thanksgiving only to find their home occupied by Defrauded Homeowners? Do John and Mary Homeowner have protection under their Eagle policy? What if they had obtained a standard Alta policy? Yes, the Eagle policy covers post policy forgeries. The standard Alta would have been denied because it was a post policy item.

Example Claim Three

After looking at homes for some time, John and Mary Homeowner purchase a condominium in Germantown, Tennessee. Although, the property was not as large as they had an open concept floor plan which included an enormous deck for entertaining. Because they enjoyed entertaining a lot, they decided that the open concept floor plan and the enormous deck would offset the smaller bedrooms upstairs. They closed on the property and purchased an eagle policy at closing. It was not long before they threw their first party and were able to entertain over 30 people with the additional outside deck area. All the guests complimented them on their new home and the wonderful outdoor entertaining space they had. Three days after their first party, the backyard neighbor knocked on their door and told them that he did not realize that the property had been sold but that their deck was on his property and it would need to be removed immediately. He had previously notified the seller of the encroachment but nothing had been resolved on the encroaching deck. A survey was done and it was determined that only 5 feet of their deck was actually situated on their land. Do John and Mary Homeowner have coverage under their eagle policy? Yes, the Eagle policy covers encroachments both onto their land and encroachments of the deck onto the other’s land.

Example Claim Four

In 2000, Pan and Kim Lee brought their two sons form China to live in the United States and purchased a home in California. They worked very hard, saving every dollar that they were able, and eventually began to invest in the California real estate market. As their properties grew in number and value, they established a family trust ad places all the properties in trust for the benefit of the family members. The eldest son completed college and married a lovely Asian girl that the family loved. However, the younger son began to date someone who was not Asian and the family was greatly distressed with this. They tried to persuade him of the family expectations but he continued with total disregard to the family wishes. In hopes of giving him time to forget his girlfriend and mature, he was sent back to China for a year to live with family members. A year later, upon his return, he immediately eloped with the original girl friend and the family saw no recourse but to disinherit him and remove him as a beneficiary from the family trust, which was worth millions by now. The son was so angered by this turn of events, that he murdered his mother, father and brother and proceeded to bury them under the family home. So the neighbors would not ask about the missing family, he told them all that they had taken an extended trip to China, which they had done previously, so no one suspected anything. He began to sell off the properties in the family trust for income, executing the deeds under forged power of attorneys. Finally, he decided to sell the family home to John and Mary Homeowner, who purchased an Eagle policy. Five years later, he was so proud that he had been able to get away with this deception and crimes that he confided in his wife as to how clever he had been and what he had actually done. The wife was so scared that she immediately reported what she knew to the proper authorities. John and Mary Homeowner come home from work one day to find yellow crime scene tape around their property. Upon inquiry, the police advised that they had found the remains for the Lee family and had arrested the son who had given them a fraudulent deed. John and Mary Homeowner immediately filed a claim under their Eagle policy. Did they have coverage and if so, what coverage were they provided? Yes, the Eagle policy covers forgery. The underwriter declared a total failure of title. Eagle policy paid 150% of original policy, the lost equity, and they paid for housing until they could find new housing.